How Much Could your Pension be Worth in 5 Years?

Imagine you have a pension pot of £100,000. Based on past performance, how would your pension pot have changed over 5 years based on reported growth of selected pension products?:

Lower Growth Fund

Cautious Managed Pension

Insured Funds Deposit S14

Moderately Cautious Plan 7IM

Gold backed pension*

Many traditional low-risk pensions are not performing how they should - some pension plans aren’t even keeping up with inflation so they’re actually losing money!

You can add gold to your pension pot by converting your existing pension pot or lump sum payment and monthly pension contributions into gold.

Of course, no-one can predict the future, but with the uncertainty in the world today, gold loves a crisis so is set to perform well. Yet even if gold only delivered half the return of the above, it would still significantly outperform the other low-risk pension options highlighted.

Sources: Nest Quarterly Investment Report, to 9.23; Scottish Widows Cautious Managed Pension Series 1 factsheet FE Precision Plus; Aviva S14 lowest risk pension, Funds Library since 15.3.19 - correct as at 18.3.24. Standard Life source FE Precision Plus; Goldprice.org actual gold price has increased by 72% in 5 years - correct at 18.3.24.

Why Gold Backed Pensions may beYour Answer to a Happier Retirement

Gold has a History of Wealth Preservation

Ongoing inflation means that cash becomes less valuable, e.g. £100 just 80 years ago would only be able to buy £1.66 worth of goods and services in 2023.

Gold has a long history of maintaining its value, e.g. 3,000 years ago, 1oz of gold could buy approx. 350 loaves of bread. Now, 1oz of gold can also buy approx. 350 loaves of artisan bread.

Download our Guide to Gold Pensions Take our Pension Quiz

Gold has a History ofThriving in Uncertain Times

At times of national or international uncertainty (created by the political, social, economic situation), people naturally want to reduce their risk and protect what they have.

As gold is considered a safe-haven asset. This uncertainty can increase the demand for gold, and therefore increase its price.

Download our Guide to Gold Pensions Take our Pension Quiz

Gold is Classed as a “Zero-Risk” Asset

Physical gold has been classed as a “zero-risk” Tier 1 asset by the Basel Committee for Banking Supervision, which creates standards for banking regulation.

Download our Guide to Gold Pensions Take our Pension Quiz

Gold Pensions are Inheritance Tax-Free

A Nest Pension is the government-led pension scheme. Upon your death, the benefits are paid directly to your estate. This means up to 40% of the pension pot could be lost to inheritance tax.

The gold in your pension pot is Inheritance Tax-Free and Capital Gains Tax-Free, so your loved ones can enjoy the benefits of your wise decisions. Beneficiaries may need to pay income tax if the pension holder dies aged 75 or over. With a gold-backed SSAS pension, you can have corporation tax relief too.

Download our Guide to Gold Pensions Take our Pension Quiz

The Risk of Equities and Long-Term Harm

Traditional pensions often place a significant amount of a fund into the stock market. So when the mark drops, the value of pensions drops too.

For example, when the UK economy plummeted in 2007, the shockwaves were felt be pension holders for many years.

“Pensioners are retiring on half the income they would have got before the financial crisis struck 10 years ago” This is Money, Sept 2017

Download our Guide to Gold Pensions Take our Pension Quiz

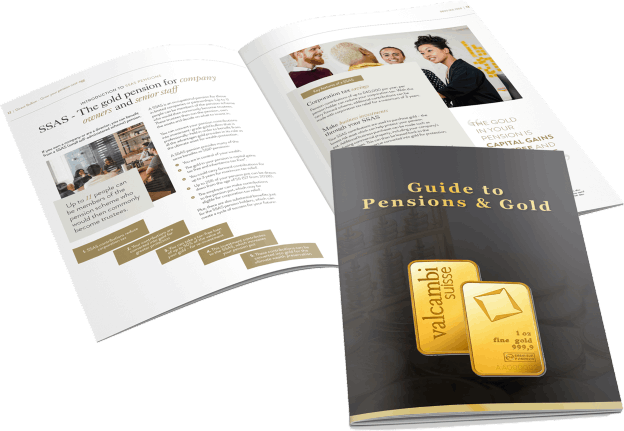

sipp.downloadourguide.header

Gain specialist content so you can discover how your pension pot can grow and be protected with gold.

-Packed with information you won’t get anywhere else.

-The shocking truth of why your pension pot does not achieve what you want.

-How your pensions nest-egg could dramatically grow with gold.

-The simple steps for protecting your pension with gold.

Call 0800 055 7050 or add your info below to immediately be emailed your copy - for free. Your data will never be sold.